When IBD Medications Face Competition: J&J’s Stelara Story

If you’ve been on Stelara for your Crohn’s disease or ulcerative colitis, you might have wondered what happens when your trusted medication faces new competition from biosimilars. It’s a question many of us in the IBD community don’t think about until it directly affects our treatment plans—but understanding how pharmaceutical companies respond to these challenges can give us insight into what might lie ahead for our care.

Johnson & Johnson’s recent experience with Stelara offers a fascinating case study in how drug companies navigate change, and what that might mean for patients who depend on their medications. Their response reveals important lessons about innovation, competition, and the future of IBD treatment options.

Summary of J&J expects innovative medicines growth despite Stelara LOE. Here’s why.

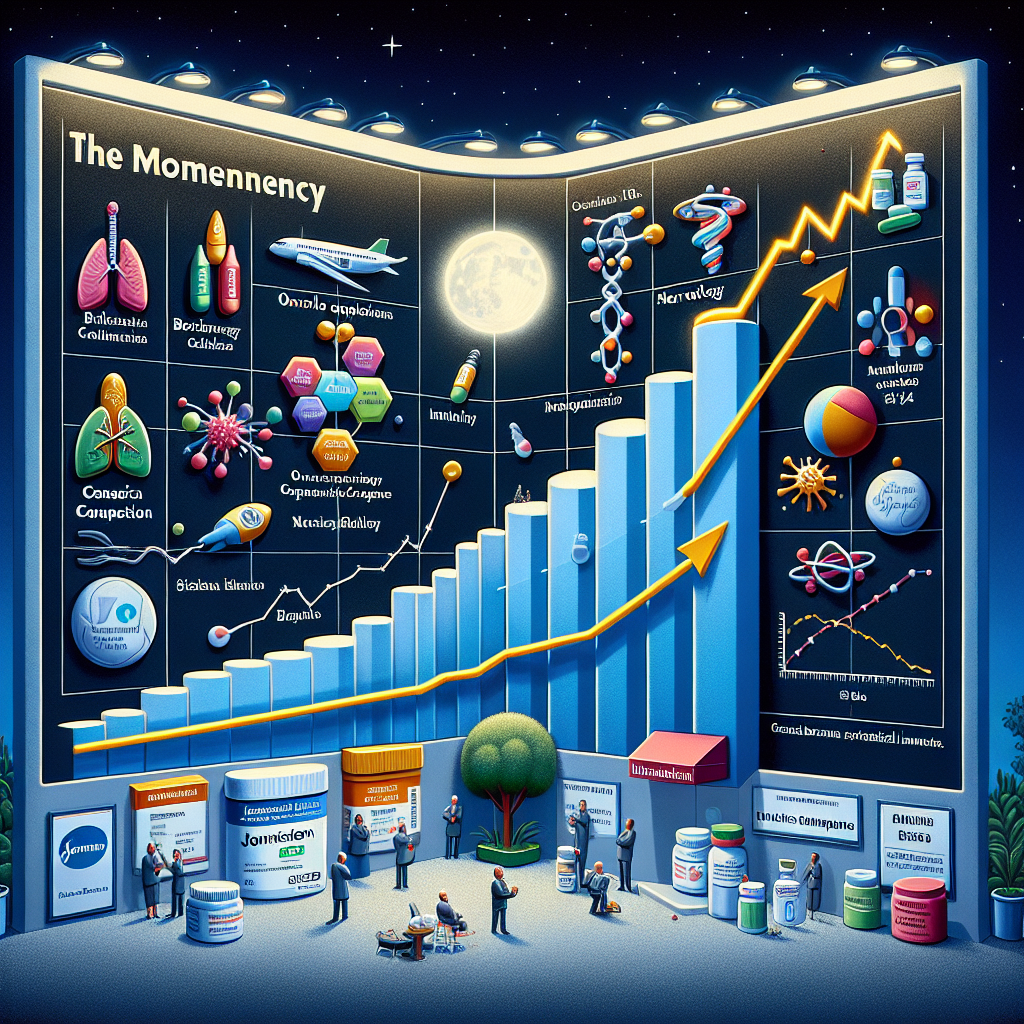

Johnson & Johnson recently reported that Stelara, one of their most successful inflammatory disease medications used to treat conditions like Crohn’s disease and ulcerative colitis, saw its sales drop by nearly half due to competition from biosimilar medications—essentially generic versions of biologic drugs. This kind of sales decline might seem catastrophic for a pharmaceutical company, but J&J’s response tells a different story.

Instead of being derailed by this setback, the company’s innovative medicines division actually hit record highs, bringing in over $15 billion in a single quarter. This growth was driven by newer medications like DARZALEX for cancer treatment and TREMFYA for immune conditions, which recently showed promising results for psoriatic arthritis. The company also made strategic investments, including acquiring Ambrx Biopharma to strengthen their cancer treatment portfolio, and increased their research and development spending to over 23% of their total sales.

This post summarizes reporting from J&J expects innovative medicines growth despite Stelara LOE. Here’s why.. Our analysis represents IBD Movement’s perspective and is intended to help patients understand how this news may affect them. Read the original article for complete details.

What This Means for the IBD Community

The story of Stelara’s sales decline and J&J’s response carries several important implications for those of us living with IBD. First, let’s address the elephant in the room: if you’re currently on Stelara and it’s working well for you, this news doesn’t mean your medication is going anywhere. Biosimilar competition typically leads to lower costs rather than medication shortages, which could actually be good news for patients and healthcare systems.

However, this situation highlights a broader trend that affects all IBD patients: the pharmaceutical landscape is constantly evolving. When blockbuster medications lose patent protection, it often signals a shift in the market that can influence everything from insurance coverage decisions to which treatments your gastroenterologist might recommend for newly diagnosed patients.

What’s particularly encouraging about J&J’s response is their commitment to continued innovation in immunology. The success of TREMFYA, which targets the same IL-23 pathway as Stelara but with potentially different benefits, suggests that the company isn’t abandoning patients with inflammatory conditions. Instead, they’re working to develop next-generation treatments that might offer improved efficacy, fewer side effects, or more convenient dosing schedules.

For current Stelara patients, this competitive pressure might actually work in your favor. Biosimilar competition typically drives down costs for the original medication, potentially making it more accessible. Additionally, the presence of multiple treatment options gives you and your doctor more flexibility in finding the right therapeutic approach for your specific situation.

It’s also worth considering what questions this raises for conversations with your healthcare team. If you’re on Stelara, you might want to discuss with your gastroenterologist whether biosimilar options could be appropriate for your situation, particularly if cost has been a concern. For those exploring treatment options, understanding the competitive landscape can help you make more informed decisions about your care plan.

The broader implication for our community is that pharmaceutical companies are being pushed to innovate rather than rest on past successes. This competitive pressure often leads to better treatments, more targeted therapies, and improved patient outcomes. J&J’s increased investment in research and development—over 23% of their sales—suggests they’re serious about developing the next generation of IBD treatments.

From a practical standpoint, this situation also underscores the importance of staying informed about your treatment options and maintaining open communication with your healthcare provider. The IBD treatment landscape changes rapidly, and what’s considered the gold standard today might be joined by equally effective but more affordable alternatives tomorrow.

Another crucial consideration is how these market dynamics might influence insurance coverage. As biosimilars become available and original medications face pricing pressure, insurance companies often adjust their formularies. This means your out-of-pocket costs could change, either for better or worse, depending on your specific insurance plan and how they respond to these market shifts.

For the IBD community as a whole, J&J’s resilience in the face of Stelara’s declining sales sends a positive signal about the commitment to continued innovation in our field. The fact that they’re doubling down on research rather than retreating suggests that pharmaceutical companies see value in developing better treatments for inflammatory bowel diseases.

Looking Ahead: Innovation in IBD Treatment

The pharmaceutical industry’s response to biosimilar competition often drives innovation in unexpected directions. When companies can no longer rely on blockbuster medications for revenue, they’re forced to develop truly innovative treatments that offer distinct advantages over existing options. For IBD patients, this competitive pressure could accelerate the development of more personalized treatments, combination therapies, or medications that address complications we currently manage separately.

J&J’s strategic investments, particularly their acquisition of companies focused on cancer treatment, might seem unrelated to IBD at first glance. However, many of the pathways involved in cancer treatment overlap with inflammatory processes, and breakthroughs in one area often lead to applications in another. The research techniques and technologies developed for oncology frequently find their way into treatments for autoimmune conditions like Crohn’s disease and ulcerative colitis.

The story of Stelara and J&J’s response ultimately reflects a healthy, competitive pharmaceutical market working as it should. When medications lose patent protection, prices typically decrease, making treatments more accessible. Simultaneously, the pressure to develop new, better treatments intensifies, potentially leading to improved outcomes for patients. This cycle of innovation and competition, while sometimes unsettling for patients worried about their current treatments, generally benefits the broader patient community over time.

For those of us living with IBD, staying informed about these industry dynamics helps us better advocate for ourselves and make more informed decisions about our care. Understanding that pharmaceutical companies face real competitive pressures can also help us appreciate why they invest so heavily in research and development—and why maintaining strong pipelines of innovative treatments matters for our long-term health outcomes.

The bottom line: While it might feel concerning to see news about your medication facing competition, J&J’s response to Stelara’s challenges actually offers reasons for optimism. Their commitment to continued innovation and substantial investment in research suggests that better treatments for IBD may be on the horizon. For current patients, biosimilar competition often means more affordable options without sacrificing efficacy. Most importantly, this competitive dynamic pushes pharmaceutical companies to keep innovating, which ultimately benefits all of us living with inflammatory bowel diseases.

IBD Movement provides information for educational purposes only. This content is not intended to be a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified health provider with any questions you may have regarding a medical condition.